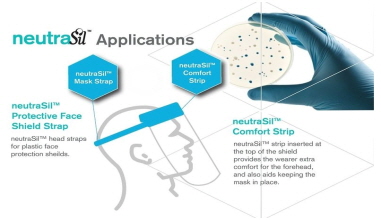

Antimicrobial silicone material finding medical, food and beverage applicationsBlackburn, England — Silicone Engineering Ltd. has introduced an antimicrobial silicone material that it claims is ideal for use in face shields used by frontline workers in health care, retail and hospitality.To combat bacteria — including MRSA, e-coli, salmonella — the neutraSil material utilizes silver ion technology, which Silicone Engineering said is highly efficient at inhibiting bacterial growth. The material combats the spread of bacteria by disabling their proton pumps and interfering with sulfhydryl proteins. This process disrupts cell wall synthesis and therefore the bacteria's functioning, according to the Blackburn-based silicones specialist.The technology is not effective against the COVID-19 virus, but it does protect against bacterias when used in face shield parts, particularly head straps and the protective cushion at the forehead.NeutraSil's useage also is not limited to faceshields."Like all of our silicone products, neutraSil is incredibly versatile," Silicone Engineering said in a statement. "Most recently, neutraSil has been used in the efforts to combat the COVID-19 virus, providing applications for critical PPE equipment including head straps and comfort strips for face protection shields, hospital door handles and surgical tray liners for the medical and health care sectors, where hygiene and sterility are so vital. It's also FDA-approved, making neutraSil ideal for use within the food and beverage and dairy industries."NeutraSil is offered in a variety of forms: sheets and rolls, extrusions (profiles, strips, cords, tubes and sections), tubing and hoses.source: https://www.plasticsnews.com/news/antimicrobial-silicone-material-finding-medical-food-and-beverage-applications

editor

2020-07-26