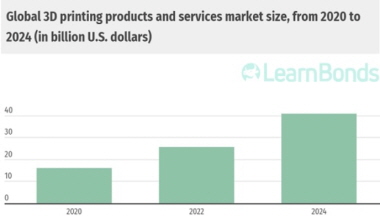

Global 3D printing industry revenue to hit US$40.8bn by 2024Constantly evolving value chains, market innovations, and cutting-edge technology developments are pushing 3D printing into the mainstream market. The global 3D printing industry revenue is expected to continue its surge 155% hitting US$40.8 billion in value by 2024, according to data gathered by LearnBonds. 3D printing enables the production of complex shapes using less material than traditional manufacturing methods, which is why it is widely used for small production runs, prototyping, small business, and educational use.In 2020, the global 3D printing industry is expected to be worth US$16 billion, revealed Wohlers Associates Annual Report on the State of 3D Printing. In the next two years, the market revenue is forecast to touch $25.5 billion. Statistics indicate the strong upward trend is set to continue in the following years, with the market revenue growing by a compound annual growth rate of 26.4% between 2020 and 2024.The State of 3D Printing Report by Sculpteo also revealed that in 2020, the most popular use case of 3D printing was prototyping among 68% of those asked, a 34% rise compared to 2017 figures. Another 59% of companies and businesses used the technology for proof of concept purposes, 36% more than three years ago.Statistics show that 49% of companies used 3D printing in production, a 27% rise on 2017. Research & education and creation of mechanical & spare parts follow with 42% and 40% of respondents, respectively.The survey also showed that 41% of those asked said that speeding up product development is one of the main reasons they use 3D. Offering customized products and limited series ranked as the second most-important reason for using the process. Increasing production flexibility was third among 12% of respondents.source : http://www.adsalecprj.com/en/news_show-69160.htmledit : HANDLER

editor

2021-04-21