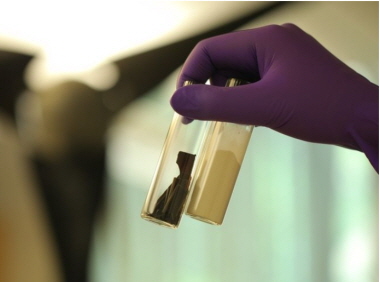

- New Compound Based on Polylactic Acid PLA from FKuRA high dimensional stability under heat and biodegradability are promised by a new compound based on polylactic acid (PLA) from FKuR Kunststoff GmbH, Willich, Germany, with the type designation Bio-Flex S7514. It was developed especially for injection molding applications. Thanks to very good flowability, the compound can also be used in multi-cavity molds and makes complete mold filling possible, even in case of long flow paths. The compound itself is 75 % bio-based. With the combination of high dimensional stability under heat and high flowability, it is predestined for use in products like those in the picure. The desired color can also be obtained using a masterbatch.Thermoplastic elastomers (TPE) under the trade name Terraprene are 40 % to 90 % bio-based. In addition to mechanical properties equivalent to those of fossil-based TPE, they can be processed using conventional injection molding, 2-component injection molding, and extrusion processes. A polypropylene with a bio-based carbon content of about 35 %, available under the trade name Terralene, can also be processed using these methods. It can be used as a drop-in thanks to the properties and processability corresponding to conventional PP.Source: Kunststoffe

Aeyoung Park

2018-10-05